Flexible financing for your manufacturing equipment needs

U.S. Bank logo

Horn Machine Tools is pleased to partner with U.S. Bank Equipment Finance in order to provide world class equipment finance solutions for its customers. U.S. Bank Equipment Finance are manufacturing industry experts and provide equipment financing solutions to help customers cut costs and operate more efficiently. Whether you’re in the metal cutting or fabrication, plastics, woodworking, glass, stone, packaging, or processing industries, we’re here to partner with you.

Flexible financing options

• Leases and loans

• Equipment lines of credit

• Payment deferrals

• Refinancing

• Rental programs (12 to 24 months)

• New or used equipment

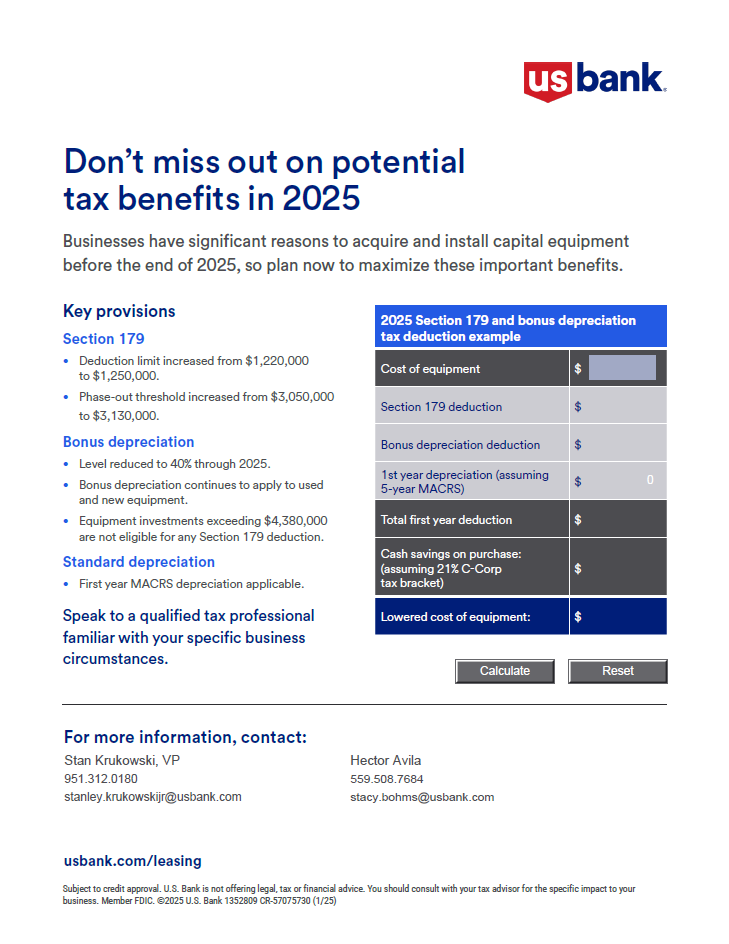

Don’t miss out on potential tax benefits in 2025

Businesses have significant reasons to acquire and install capital equipment before the end of 2025, so plan now to maximize these important benefits.

Key provisions

Section 179

• Deduction limit increased from $1,220,000 to $1,250,000

• Phase-out threshold increased from $3,050,000 to $3,130,000

Bonus depreciation

• Level reduced to 40% through 2025

• Bonus depreciation continues to apply to used and new equipment

• Equipment investments exceeding $4,380,000 are not eligible for any Section 179 deduction

Standard depreciation

• First year MACRS depreciation applicable

Speak to a qualified tax professional familiar with your specific business circumstances

For more information, contact:

usbank.com/mvs

“World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Etisphere LLC.

Credit products are subject to normal credit approval and program guidelines. Some restrictions and fees may apply. Financing maximums and terms are determined by borrower qualifications and use of funds. Interest accrues during any deferred payment and is amortized over the remaining balance and term U.S. Bank and its representatives do not provide tax advice. Consult a specialist regarding your financial situation.

U.S. Bank logo